All Categories

Featured

Table of Contents

The are whole life insurance policy and universal life insurance. The cash money worth is not included to the death benefit.

After 10 years, the cash money worth has grown to roughly $150,000. He obtains a tax-free lending of $50,000 to begin an organization with his bro. The policy funding rate of interest price is 6%. He repays the loan over the next 5 years. Going this route, the rate of interest he pays goes back right into his policy's cash money value as opposed to a monetary institution.

Infinite Banking Course

Nash was a financing professional and fan of the Austrian college of economics, which advocates that the worth of items aren't clearly the result of standard financial frameworks like supply and demand. Rather, individuals value cash and products in different ways based on their economic status and requirements.

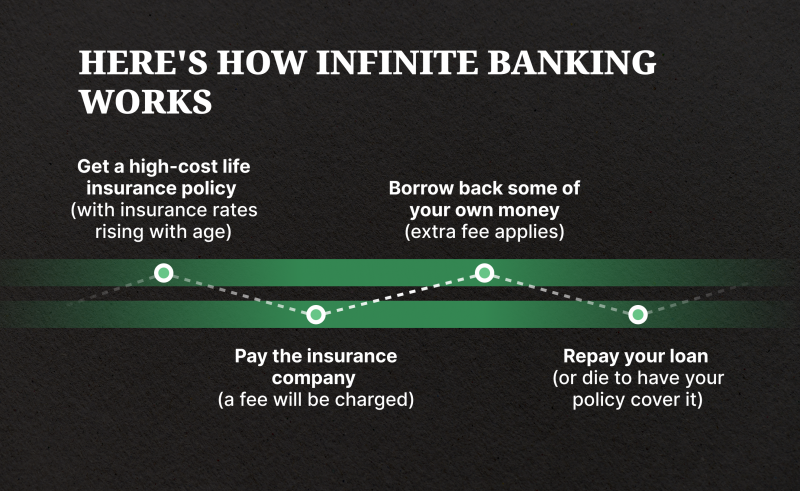

Among the challenges of typical financial, according to Nash, was high-interest rates on financings. Way too many people, himself consisted of, got involved in economic problem because of reliance on financial organizations. Long as financial institutions set the rate of interest prices and loan terms, individuals didn't have control over their own wealth. Becoming your very own banker, Nash figured out, would put you in control over your monetary future.

Infinite Banking requires you to possess your monetary future. For goal-oriented individuals, it can be the finest financial device ever before. Below are the advantages of Infinite Banking: Perhaps the solitary most helpful element of Infinite Financial is that it improves your cash money flow.

Dividend-paying entire life insurance policy is really reduced threat and uses you, the policyholder, an excellent bargain of control. The control that Infinite Financial offers can best be organized into 2 groups: tax advantages and asset defenses - cipher bioshock infinite bank. Among the reasons whole life insurance coverage is perfect for Infinite Banking is how it's strained.

Become My Own Bank

When you make use of entire life insurance policy for Infinite Financial, you participate in a personal agreement between you and your insurer. This personal privacy offers specific possession protections not found in various other economic lorries. These protections may differ from state to state, they can include protection from property searches and seizures, defense from reasonings and security from lenders.

Whole life insurance coverage plans are non-correlated assets. This is why they function so well as the economic structure of Infinite Banking. Despite what occurs on the market (stock, actual estate, or otherwise), your insurance plan retains its well worth. Also lots of people are missing this vital volatility barrier that helps protect and expand wide range, rather breaking their cash right into two pails: savings account and financial investments.

Entire life insurance policy is that third bucket. Not just is the price of return on your entire life insurance policy guaranteed, your death advantage and costs are also assured.

Right here are its main advantages: Liquidity and accessibility: Plan finances give instant access to funds without the constraints of typical bank car loans. Tax obligation efficiency: The cash money value grows tax-deferred, and plan financings are tax-free, making it a tax-efficient tool for developing riches.

How To Start Infinite Banking

Possession defense: In several states, the cash money value of life insurance coverage is shielded from financial institutions, including an additional layer of monetary safety. While Infinite Banking has its merits, it isn't a one-size-fits-all solution, and it features substantial drawbacks. Here's why it may not be the very best technique: Infinite Financial frequently needs detailed plan structuring, which can perplex policyholders.

Imagine never ever having to worry regarding financial institution financings or high passion rates once again. That's the power of boundless banking life insurance coverage.

There's no set loan term, and you have the freedom to pick the payment timetable, which can be as leisurely as paying back the finance at the time of fatality. This adaptability reaches the maintenance of the fundings, where you can go with interest-only payments, keeping the lending equilibrium level and workable.

Holding money in an IUL dealt with account being credited interest can typically be much better than holding the cash on deposit at a bank.: You have actually always imagined opening your own bakery. You can borrow from your IUL plan to cover the initial expenditures of leasing a room, buying tools, and employing staff.

Cash Flow Whole Life Insurance

Individual lendings can be obtained from conventional banks and lending institution. Here are some bottom lines to consider. Credit rating cards can give a versatile means to obtain cash for extremely temporary durations. Nonetheless, borrowing money on a credit score card is typically very costly with interest rate of interest (APR) frequently reaching 20% to 30% or more a year.

The tax obligation therapy of plan car loans can differ significantly depending on your nation of home and the certain regards to your IUL policy. In some areas, such as North America, the United Arab Emirates, and Saudi Arabia, plan car loans are usually tax-free, supplying a significant advantage. However, in various other jurisdictions, there might be tax implications to take into consideration, such as possible tax obligations on the loan.

Term life insurance policy just offers a fatality advantage, with no money worth buildup. This suggests there's no cash money worth to borrow against. This short article is authored by Carlton Crabbe, Chief Exec Police Officer of Resources forever, an expert in giving indexed global life insurance policy accounts. The info offered in this write-up is for academic and educational functions just and should not be construed as economic or investment suggestions.

For funding policemans, the comprehensive guidelines enforced by the CFPB can be seen as troublesome and restrictive. Financing policemans frequently suggest that the CFPB's policies produce unneeded red tape, leading to more documents and slower finance handling. Policies like the TILA-RESPA Integrated Disclosure (TRID) policy and the Ability-to-Repay (ATR) demands, while targeted at safeguarding customers, can cause hold-ups in shutting offers and enhanced operational costs.

Latest Posts

Become Your Own Bank To Grow, Protect & Control Your Wealth

Infinite Banking Concept Reddit

Start Your Own Bank, Diy Bank Establishment